Discover What Is Staking In Cryptocurrency: Generate Passive Income And Trade On BitNasdaq!

2024-06-11 07:39:24

Want to maximize your cryptocurrency investments and generate passive income? Investing in cryptocurrencies is as simple as staking!

In this comprehensive guide, we'll take you through the ins and outs of staking, from understanding what it is to how you can profit from it. Plus, we'll show you how staking can seamlessly link with crypto trade exchanges for an enhanced trading experience.

Read on to explore the nitty gritty of staking!

What Is Staking In Cryptocurrency?

What is staking in cryptocurrency is a concept where you can earn rewards on your cryptocurrency holdings by actively participating in securing and validating transactions on a blockchain network. It's like depositing cash in a high-yield savings account, but instead of earning interest from a bank, you earn additional cryptocurrency rewards.

Staking is primarily based on the Proof of Stake (PoS) consensus mechanism, which aims to achieve network security and efficiency. By staking your crypto assets, you contribute to the validation process, and in return, you receive more cryptocurrency as a reward.

The staking feature is exclusive to blockchains like Ethereum and Cardano and thrives on the innovative proof-of-stake (PoS) consensus mechanism. Unlike the proof-of-work (PoW) system employed by prominent cryptocurrencies such as Bitcoin, PoS unveils a distinctive approach, where the validation of transactions is entrusted to participants who possess and "stake" their coins.

This process, however, does come with its own consequences. Staking coins engenders a certain degree of illiquidity, curtailing their immediate availability. Users who voluntarily enter the world of staking see their valuable coins caught in the web of this practice.

Though individuals typically retain the ability to access their staked coins, their freedom to employ them for alternate purposes remains constricted until they extricate them from the staking.

Indeed, the feature of staking grants users an opportunity to contribute to the vitality and security of the blockchain, while simultaneously leaving an indelible mark on their own holdings.

As the world of decentralized finance continues to evolve, staking stands as a testament to the ingenious possibilities offered by blockchain technology, attracting those seeking both financial growth and meaningful participation.

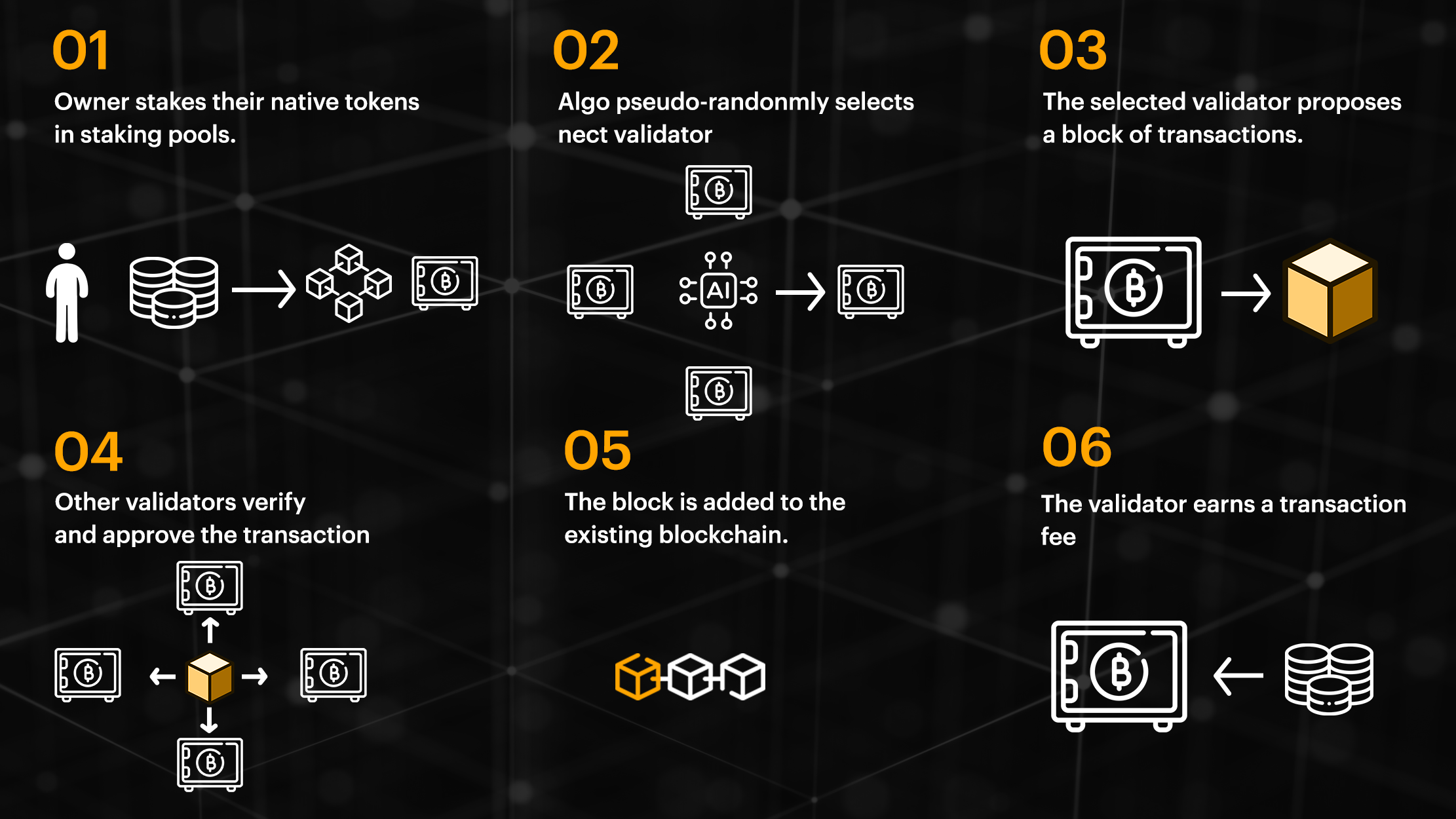

Proof Of Stake Consensus Mechanism As we continue to revolve around the subject of what is staking, it is significant to explain how the mechanism works. The PoS (proof of Stake) consensus algorithm employs here is a pseudo-random selection process to designate validators from a pool of nodes. This selection mechanism takes into account various factors such as stake age, randomization, and node wealth.

In the PoS model, blocks are forged rather than mined. When a node is chosen to forge the next block, it undertakes the responsibility of verifying the validity of transactions within the block. Once verified, the node signs and adds the block to the blockchain, receiving transaction fees and, in some cases, a coin reward as a token of appreciation.

One of the key advantages of using PoS is its ability to facilitate block production without relying on specialized mining hardware like ASICs. Unlike the significant hardware investment and energy consumption associated with ASIC mining, staking necessitates an investment in the cryptocurrency itself.

However, it is important to note that each PoS cryptocurrency possesses its own distinct set of rules and methods, carefully combined to create what it believes to be the optimal configuration for the network and its users.

It is often argued that the introduction of block production through staking enhances the scalability potential of blockchains. This very rationale has motivated the Ethereum network to embark on a series of technical upgrades, collectively known as ETH 2.0, transitioning from PoW to PoS. By harnessing the power of PoS, blockchain networks strive to achieve greater efficiency, security, and adaptability, thereby opening new horizons for decentralized innovation.

How Does Staking Work?

Understanding what is staking has now been unfolded, and we know that staking is a reasonably basic process involving a few key steps:

Choose a Staking-Capable Cryptocurrency:Not all cryptocurrencies support staking, so it's crucial to select a cryptocurrency that operates on a PoS model. Popular staking-compatible cryptocurrencies include Ethereum (ETH), Cardano (ADA), Solana (SOL), Qitcoin(QTC), and Polkadot (DOT).

Set Up a Wallet: To stake your cryptocurrency, you'll need a compatible wallet that supports staking. This wallet acts as a secure storage for your assets and facilitates the staking process.

Select a Staking Pool:While staking can be done individually, many users prefer to join staking pools. These pools combine the staked assets of multiple users, increasing the chances of earning rewards. When selecting a staking pool, consider factors like reliability, fees, and pool size to make an informed choice.

Start Staking: Transfer your chosen cryptocurrency from your exchange account to your staking wallet. Then, delegate your assets to the staking pool of your choice. By doing so, you contribute to the network's security and validation process.

Earn Rewards and Trade: As a staker, you'll receive regular rewards in the form of additional cryptocurrency. These rewards can be accumulated and used for trading purposes on crypto trade exchanges, offering you the opportunity to further grow your portfolio.

The Synergy Between Staking And Crypto Trade Exchanges

Staking and crypto trade exchanges go hand in hand, creating a symbiotic relationship that enhances your trading experience. Here's how they complement each other:

Diversification: Staking allows you to earn rewards on your crypto assets while holding them, reducing the need for constant buying and selling. This promotes a long-term investment strategy and complements your trading activities on exchanges.

Passive Income Generation:Staking provides a consistent and passive income stream through the accumulation of rewards. You can reinvest these rewards into your trading activities on crypto exchanges, potentially boosting your profits.

Portfolio Growth: By staking and earning additional cryptocurrency, you expand your portfolio and have more assets available for trading. This increased portfolio size can offer greater flexibility and trading opportunities on exchanges.

Risk Management:Staking rewards act as a hedge against market volatility. If the value of your staked assets decreases, the rewards earned through staking can help offset potential losses incurred during trading on exchanges.

Access to DeFi Opportunities: Staking is often interconnected with decentralized finance (DeFi) applications, which enable advanced trading strategies, yield farming, and liquidity provision. By staking and utilizing DeFi platforms, you can unlock additional trading options and potential profit avenues on crypto trade exchanges.

Crypto Staking & BitNasdaq

BitNasdaq- the best Cryptocurrency Exchange platform offers a staking platform for their users. To participate in staking on BitNasdaq, sign up for a new account. Complete the necessary verification process if required.

Deposit the specific cryptocurrency you wish to stake and Choose a Staking Project through the available projects and select the one you are interested in staking. You may now need to enter the staking amount and confirm your participation.

After successfully staking your cryptocurrency, you can monitor your staking status through your BitNasdaq account. Depending on the specific staking project, you will accumulate rewards over time. These rewards are typically distributed periodically or at the end of the staking period.

BitNasdaq is currently offering four types of financial staking schemes through which you can generate income on your own terms. Let's go over each financial model to help you get over the quick idea and easily get on board with it.

Locked Saving

An investment in a locked saving plan earns up to 25 - 10% APY (Annual Percentage Yield) for a set period of time, and you are unable to take a profit before that term has passed. You can choose a time limit of up to 360 days, for example.

ETH, BTC, USDT, and QTC are available on BitNasdaq for the locked saving plan. Your savings will be locked, giving you plenty of time to study trade and analyze the latest market trends.

Therefore, HODLers who wish to use their assets while they aren't trading should choose a locked saving plan. Join the Locked Savings Plan now!

Flexible Saving

You can create a personalized savings plan using your BTC, ETH, USDT, and QTC assets to earn 2% to 10% APY. A flexible strategy has no expiration date and will enable you to increase profits while doing nothing. The flexible saving plan is for those who want to put away their funds without being constrained by time or other factors. HODL Flexibly and subscribe to a flexible savings plan.

Locked Hybrid Financing

You can stake your assets in pairs using locked hybrid financing. For instance, you could stake BTC and withdraw the profits in the designated pairing currency, such as USDT. On your hybrid financial plan, you can manually choose your staked currency, your locked time, and the APY returns up to 20% to 10%.

For those looking to make money while avoiding the inconvenience of converting their assets, locked hybrid finance is the solution.

Flexible Hybrid Financing

Your assets will now be staked in the flexible hybrid model together with your choice cryptocurrency, and you will receive the profits in the designated currency. Your earning potential under this plan's maximum returns ranges from 10% to 2%.

This strategy is for everyone and will make staking more convenient while assisting you in generating maximum and reliable returns.

Take The Next Step!

Now that you understand what is staking in cryptocurrency and its synergy with crypto trade exchanges, it's time to take action. Begin by researching staking-compatible cryptocurrencies, setting up a secure wallet, and exploring reputable staking pools. Once you start earning rewards through staking, you can leverage those assets on crypto trade exchanges to trade, diversify your holdings, and capitalize on market opportunities.

Don't miss out on the potential of staking and crypto trading combined. Embrace staking, earn passive income, and optimize your trading experience on BitNasdaq to earn unlimited rewards on your staked assets and trade effectively.

Start your journey today and unlock the full potential of your crypto assets!

HODL on!

Share

Share

Like

Like

Dislike

Dislike