What Are Spot Trigger Orders?

Xiaoyuyuy

Updated at: 6 months ago

What Are Spot Trigger Orders?

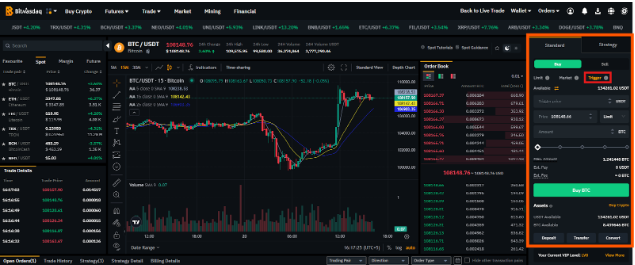

Spot Trigger Orders are a powerful feature offered by BitNasdaq, designed to provide traders with advanced control over their trades. This feature is especially useful in volatile market conditions and executing trades efficiently between predefined price points.

Understanding Spot Trigger Orders

Spot Trigger Orders are conditional orders that only activate when the market reaches a specified trigger price. Once this price is reached, the order is added to the order book for execution based on your predefined conditions. This feature combines precision and automation to help traders capitalize on market opportunities.

How Spot Trigger Orders Work On BitNasdaq

-

Set the Trigger Price: Choose the price level at which you want your order to be triggered and added to the order book.

-

Define Market or Limit Price: After the trigger price is reached, set whether the trade should execute at the market price or a specific limit price.

Specify Trade Amount: Enter the amount of crypto or USDT you wish to use for the trade.

Once configured, the order executes automatically upon meeting the trigger conditions, ensuring a more controlled trading experience.

Significance Of Spot Trigger Orders

Spot Trigger Orders are vital for traders who want to:

-

Manage Risk: Protect against unexpected market swings by automating order placement.

-

Seize Opportunities: Execute trades at optimal price points without constantly monitoring the market.

-

Improve Efficiency: Streamline trading strategies and reduce manual intervention.

BitNasdaq's Spot Trigger Orders empower traders with flexibility and precision, making it easier to navigate the complexities of cryptocurrency trading. By leveraging this feature, traders can execute strategies confidently and maximize potential gains in the markets.