What is P2P Trading? And how does it work in the world of crypto?

财经不求人

Updated at: 6 months ago

P2P trading, also known as peer-to-peer trading, in the context of cryptocurrency, refers to the direct exchange of digital assets between two parties without the involvement of intermediaries such as centralized exchanges. It allows individuals to trade cryptocurrencies directly with each other using a decentralized platform or marketplace.

How P2P Trading Works

Here's a detailed explanation of how P2P trading works:

Decentralized Platforms

P2P trading platforms are typically decentralized, meaning they don't rely on a central authority to facilitate trade. Instead, they utilize blockchain technology and smart contracts to enable direct transactions between buyers and sellers.

Matching Buyers and Sellers

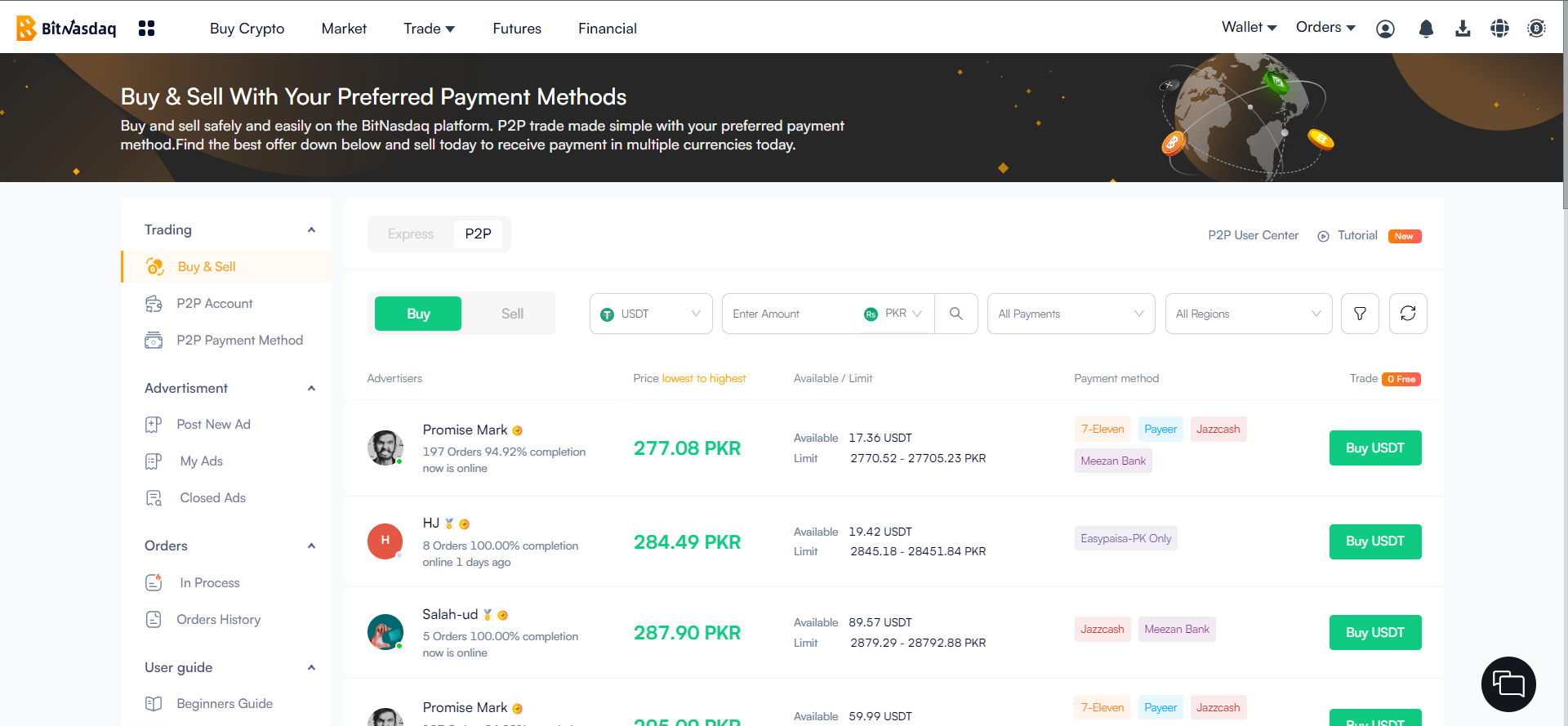

P2P platforms connect buyers and sellers by matching their trade requirements. Users can create listings specifying the cryptocurrency they want to buy or sell, the desired price, and the preferred payment method.

Order Book

P2P platforms often have an order book that displays active buy and sell orders. Buyers can browse these orders to find a suitable seller, while sellers can find interested buyers. Once a match is found, the trading process begins.

Escrow Service

To ensure secure transactions, P2P platforms often employ an escrow service. When a trade is initiated, the buyer sends the agreed-upon amount of cryptocurrency to an escrow account. The seller, in turn, confirms the receipt of payment, and the escrow service holds the funds until both parties fulfill their obligations.

Transaction Completion

Once the payment is confirmed by the seller and the escrow service, the cryptocurrency is released to the buyer's wallet. The trade is considered complete, and both parties can leave feedback or ratings on the platform to build trust within the community.

Pros of P2P Trading

Privacy: P2P trading allows users to maintain a higher level of privacy compared to centralized exchanges as it bypasses the need for KYC (Know Your Customer) verification in some cases.

Direct Ownership: P2P trading enables direct ownership of the traded cryptocurrencies. Users have control over their private keys and don't need to rely on an exchange to hold their assets.

Flexibility: P2P platforms offer a wide range of cryptocurrencies for trading, giving users more options compared to some centralized exchanges.

Global Accessibility: P2P trading is not limited by geographic boundaries, allowing users from different countries to trade with each other.

Cons of P2P Trading

Counterparty Risk: P2P trading involves interacting directly with other individuals, which introduces counterparty risk. Users need to be cautious and verify the reputation and trustworthiness of the trading partner before conducting a transaction.

Price Volatility: P2P trading may face price volatility, as trades are based on the agreement between individual buyers and sellers. Prices can vary between different sellers, which can lead to discrepancies.

Limited Liquidity: P2P platforms may have lower liquidity compared to centralized exchanges, which means it might be more challenging to find a match for your trade or execute large orders quickly.

Security Concerns: While P2P trading platforms implement security measures, there is still a risk of scams, fraudulent activities, or hacking attempts. Users should exercise caution and adopt security best practices to mitigate these risks.

How to Use P2P Trading

Register on a P2P platform: Users create an account on a P2P trading platform, providing the necessary information and completing any required verification processes.

Choose the desired cryptocurrency: Users select the cryptocurrency they want to buy or sell.

Specify trade details: Users set their preferred price, the amount of cryptocurrency they wish to buy or sell, and the payment method they are willing to use.

Browse available offers: Buyers can search for suitable sell offers, while sellers can search for interested buyers on the platform's order book.

Initiate a trade: Once a suitable match is found, users initiate the trade by agreeing to the terms and conditions set by both parties.

Complete the transaction: Users follow the platform's instructions to transfer the agreed-upon payment or cryptocurrency and confirm the completion of the transaction.

Safety Tips for P2P Trading

Reputation and Feedback: Check the reputation and feedback of the trading partner before engaging in a transaction. Look for positive ratings, completed trades, and user reviews.

Secure Communication: Use encrypted communication channels within the platform or external encrypted messaging apps to protect sensitive information during trade negotiations.

Escrow Service: Prefer platforms that offer an escrow service to hold funds until the trade is completed successfully. This reduces the risk of fraud and provides an intermediary layer of security.

Two-Factor Authentication (2FA): Enable 2FA on your P2P trading platform account to add an extra layer of security to your login process.

Research and Due Diligence: Conduct thorough research on the platform you plan to use, read user reviews, and stay updated on potential security concerns or scams in the P2P trading space.

While P2P trading can offer benefits such as privacy and direct ownership, users should remain vigilant, perform due diligence, and be aware of the risks involved.