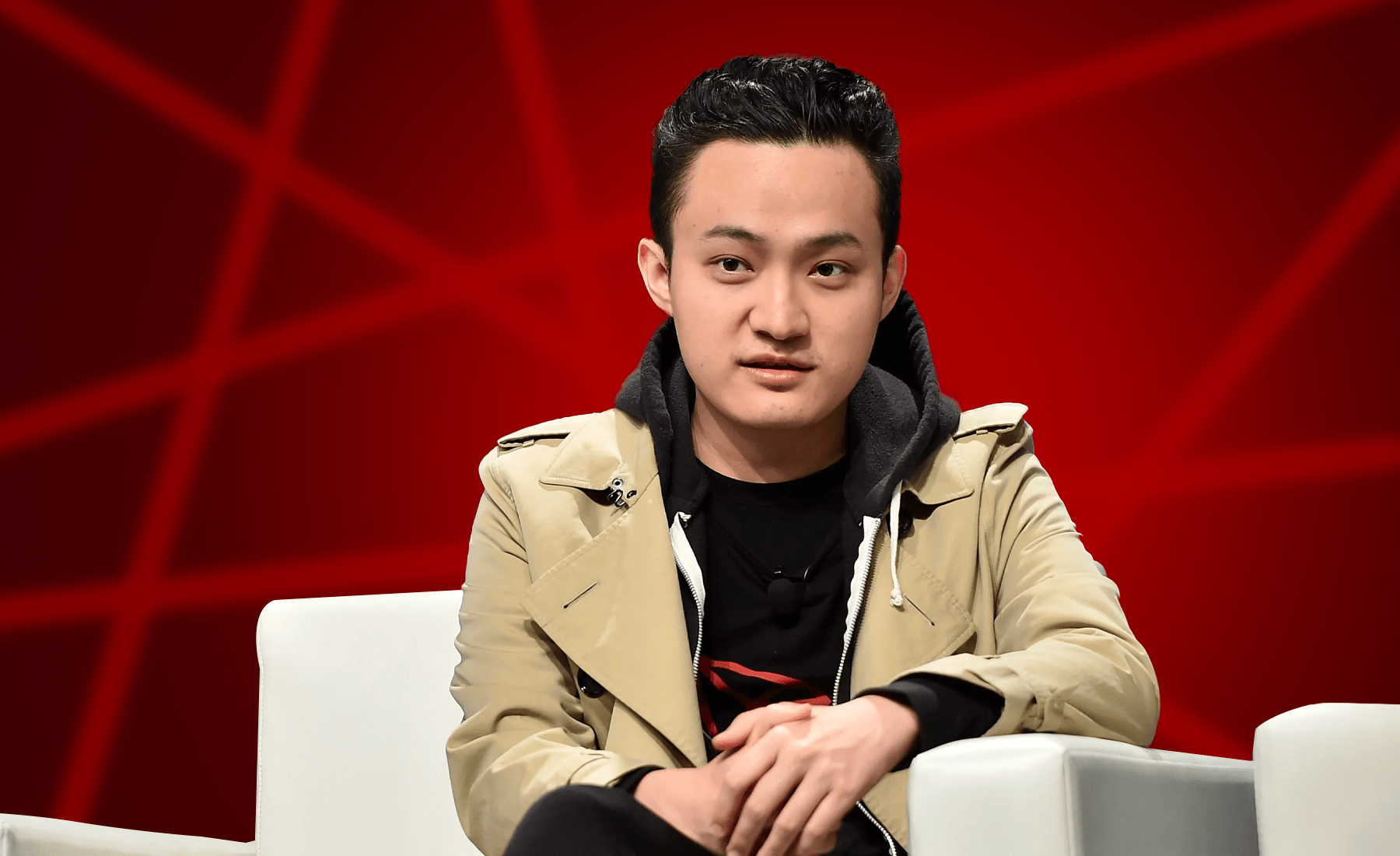

Sun had been facing SEC allegations since 2023 that he offered unregistered securities, but the agency requested a stay in February 2025, only weeks after the departure of former SEC Chair Gary Gensler. The lawmakers suggested that Sun’s “sizable investments” in crypto ventures tied to President Donald Trump and his family — including World Liberty Financial and the Official Trump memecoin (TRUMP), which currently trades near $8.64 — may have influenced the enforcement decision.

“Given the litany of issues associated with Mr. Sun’s investments in the President’s cryptocurrency ventures and his plans to take Tron public through the reverse merger process, we request that the SEC ensure that Tron Inc. meets the rigorous standards necessary to be listed on US stock exchanges,” the lawmakers wrote.

Investor Takeaway

Concerns Over Tron’s Nasdaq Listing

Merkley and Casten also flagged Tron’s July reverse merger that allowed the company to list shares on the Nasdaq. They argued that the process raises “financial and national security risks,” pointing to Sun’s alleged connections with the Chinese government. A reverse merger allows a private company to go public by merging with an already-listed shell company, bypassing some of the traditional IPO requirements.

The letter asked whether the SEC could adequately protect investors if it settles its case with Sun and whether Tron’s listing process had received proper scrutiny. While specifically naming Tron, the concerns could apply to other foreign crypto firms that may seek US listings through reverse mergers or similar structures.

As of publication, Tron had not commented on the lawmakers’ letter. The company’s silence underscores the sensitivity of its position as both a high-profile blockchain network and now a publicly listed entity in the United States.

SEC Shifts Under New Leadership

Since Trump took office, the SEC under Atkins has changed its approach to digital assets, dismissing investigations or enforcement cases against multiple crypto companies. This shift has raised questions about whether regulatory policy is being relaxed for political or economic reasons. For Tron, the timing of the enforcement stay just as its Nasdaq debut was completed has drawn particular scrutiny.

Prosecutors and regulators have long warned that reverse mergers and offshore-linked entities pose heightened risks for US markets. Lawmakers fear that firms with complex ownership structures and geopolitical ties could exploit regulatory gaps, especially if enforcement actions are softened or dropped altogether.

Pending Legislation Could Rewrite the Rules

Even as lawmakers pressure the SEC, the entire framework for digital asset regulation in the US could soon change. In July, the Republican-controlled House passed the CLARITY Act, which sets the groundwork for a crypto market structure bill. Senate Banking Committee leaders have said they plan to build on the legislation, with a comprehensive framework expected by 2026.

Draft versions of the bill suggest modernizing digital asset rules, clarifying the roles of the SEC and the Commodity Futures Trading Commission (CFTC), and potentially streamlining the process for crypto companies to list on US exchanges. For Tron and others, this legislation could remove barriers or create new restrictions depending on its final form.

Whether Congress’s scrutiny of Tron will lead to immediate regulatory changes is unclear. But the episode signals that foreign crypto firms with ties to politically sensitive entities should expect greater oversight when seeking access to US public markets.

Share

Share

Like

Like

Dislike

Dislike